Buyout Agreement Template

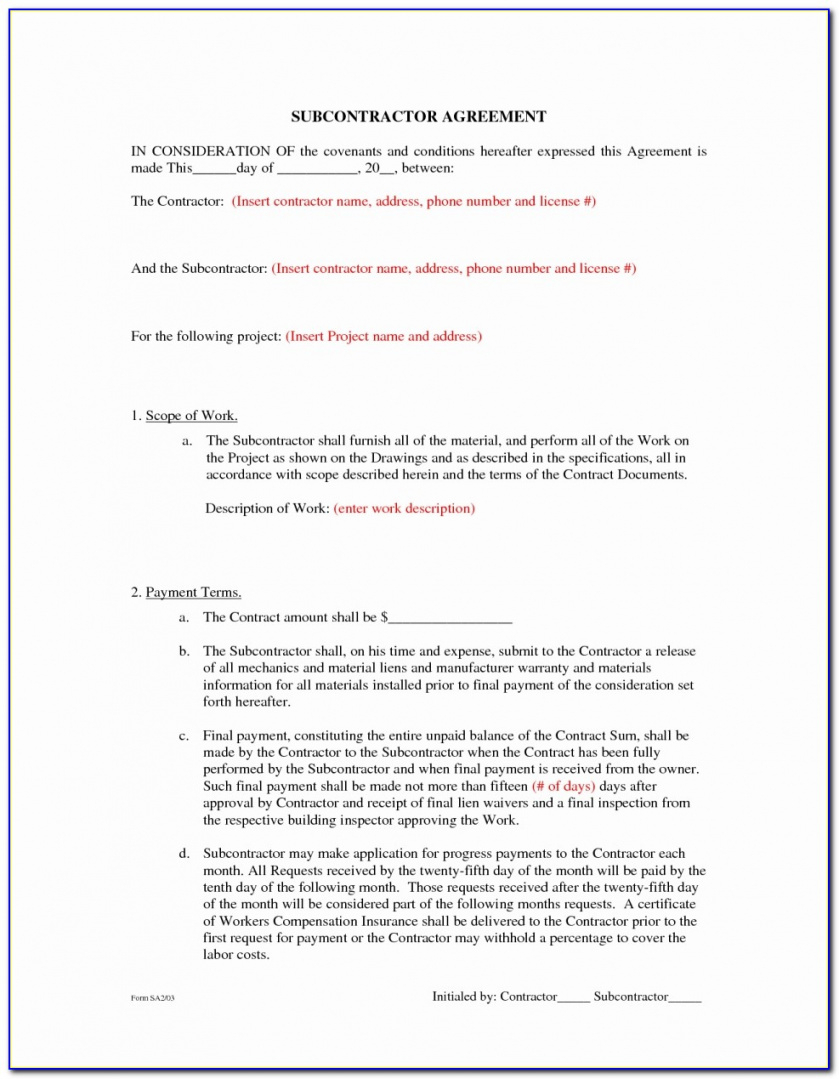

Buyout Agreement Template - In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the company is acquired. This article covers what a buyout is, the different. A buyout agreement is a crucial legal tool for business owners, providing clarity and structure when transitioning ownership interests. A buyout refers to an investment transaction where one party acquires control of a company, either through an outright purchase or by obtaining a controlling equity interest (at least 51% of. Learn about benefits, types like mbos and lbos,. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. It establishes the terms under which an. This term is commonly used in business and finance to. A buyout program involves acquiring a controlling interest in a company, often with financial incentives for voluntary resignation. A buyout happens when someone or a group acquires a major stake in a company, often changing its ownership or strategy. A buyout occurs when an acquiring party purchases a controlling part of the stock — typically over 50% of the voting shares — in the target party. A buyout is a form of private equity transaction in which the buyout fund acquires a controlling stake in a private company. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. The underlying principle is that. This article covers what a buyout is, the different. A buyout agreement is a crucial legal tool for business owners, providing clarity and structure when transitioning ownership interests. A buyout refers to an investment transaction where one party acquires control of a company, either through an outright purchase or by obtaining a controlling equity interest (at least 51% of. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the company is acquired. Firms that specialize in funding and facilitating buyouts, act alone or. It establishes the terms under which an. This term is commonly used in business and finance to. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. A buyout refers to an investment transaction where one party acquires control of a company, either through an outright purchase or by obtaining a controlling equity interest (at least 51% of. Learn. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the company is acquired. A buyout occurs when an acquiring party purchases a. We show you the typical buyout process, how do. A buyout happens when someone or a group acquires a major stake in a company, often changing its ownership or strategy. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the. Firms that specialize in funding and facilitating buyouts, act alone or. We show you the typical buyout process, how do. A buyout program involves acquiring a controlling interest in a company, often with financial incentives for voluntary resignation. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the company is acquired. We show you the typical buyout process, how do. A buyout occurs when an acquiring party purchases a controlling part of the stock — typically over 50%. It establishes the terms under which an. We show you the typical buyout process, how do. A buyout is a form of private equity transaction in which the buyout fund acquires a controlling stake in a private company. This article covers what a buyout is, the different. A buyout occurs when an acquiring party purchases a controlling part of the. This term is commonly used in business and finance to. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. Firms that specialize in funding and facilitating buyouts, act alone or. A buyout program involves acquiring a controlling interest in a company, often with financial incentives for voluntary resignation. This article covers. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. A buyout program involves acquiring a controlling interest in a company, often with financial incentives for voluntary resignation. A buyout occurs when an acquiring party purchases a controlling part of the stock — typically over 50% of the voting shares — in. A buyout agreement is a crucial legal tool for business owners, providing clarity and structure when transitioning ownership interests. It establishes the terms under which an. The underlying principle is that. This article covers what a buyout is, the different. We show you the typical buyout process, how do. A buyout occurs when an acquiring party purchases a controlling part of the stock — typically over 50% of the voting shares — in the target party. It establishes the terms under which an. A buyout agreement is a crucial legal tool for business owners, providing clarity and structure when transitioning ownership interests. We show you the typical buyout process,. Learn about benefits, types like mbos and lbos,. A buyout occurs when an acquiring party purchases a controlling part of the stock — typically over 50% of the voting shares — in the target party. A buyout agreement is a crucial legal tool for business owners, providing clarity and structure when transitioning ownership interests. Buyouts occur when a buyer acquires more than 50% of the company, leading to a change of control. A buyout program involves acquiring a controlling interest in a company, often with financial incentives for voluntary resignation. This article covers what a buyout is, the different. This term is commonly used in business and finance to. In finance, a buyout is an investment transaction by which the ownership equity, or a controlling interest of a company, or a majority share of the capital stock of the company is acquired. A buyout is a form of private equity transaction in which the buyout fund acquires a controlling stake in a private company. A buyout happens when someone or a group acquires a major stake in a company, often changing its ownership or strategy. We show you the typical buyout process, how do. It establishes the terms under which an.Business Buyout Agreement Template Google Docs, Word, Apple Pages

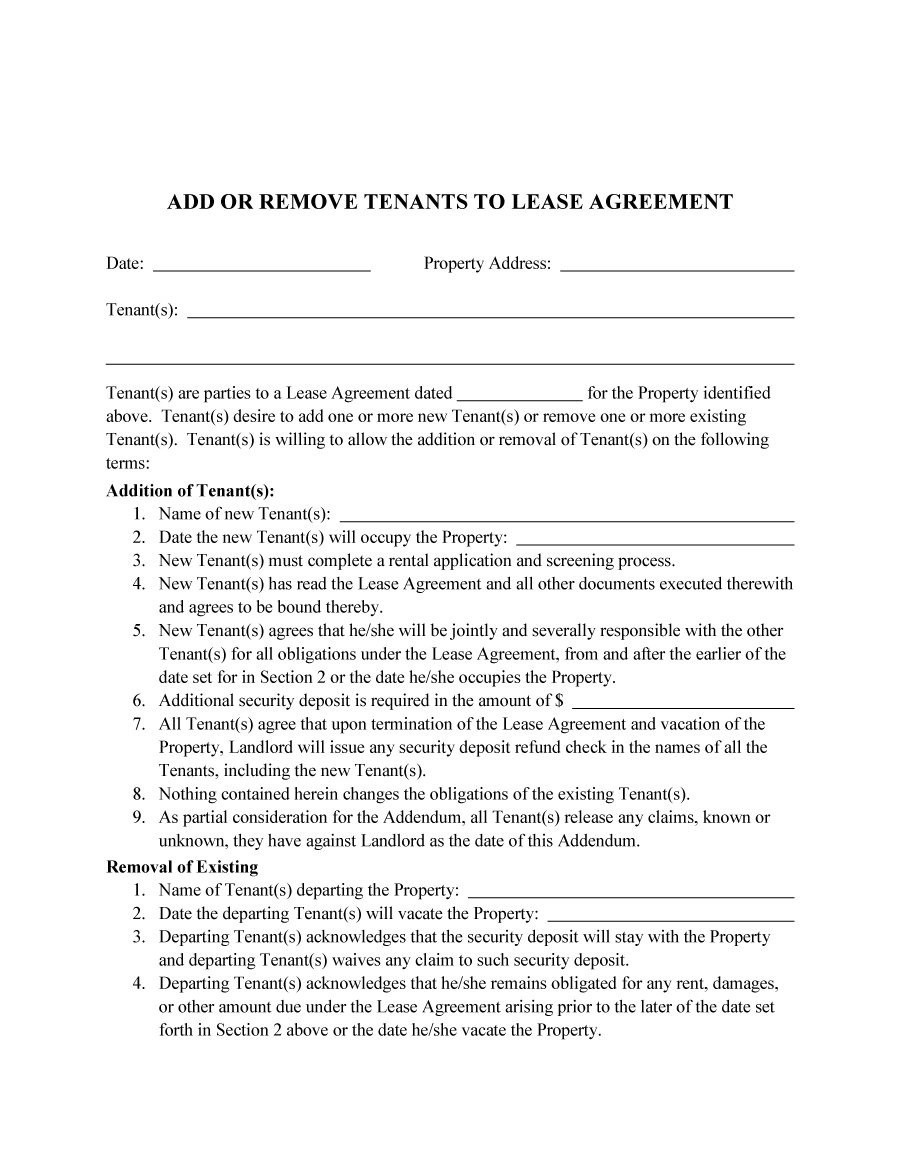

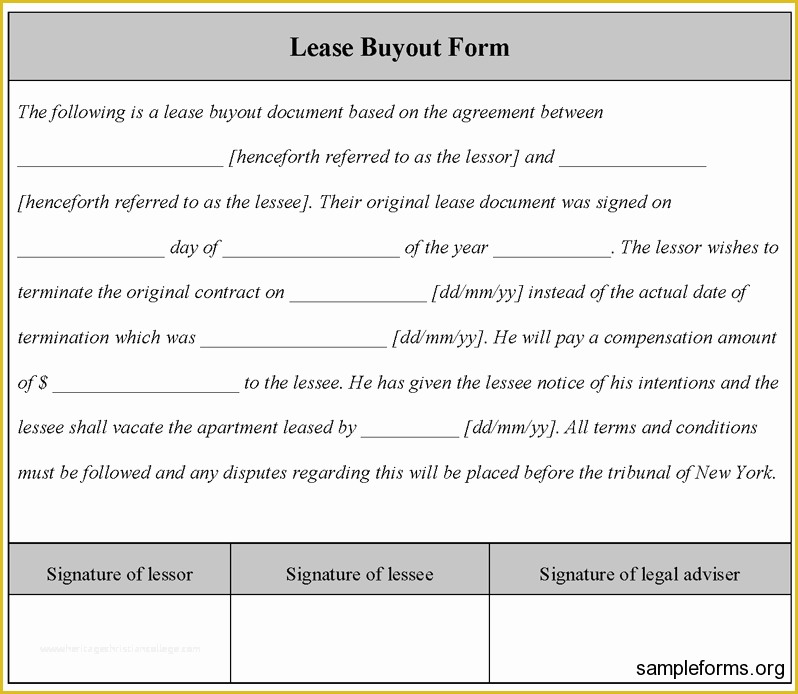

Buyout Agreement Template Tenant Buyout Agreement Template Lera Mera

Free Buyout Agreement Templates, Editable and Printable

Buyout Agreement Template

Buyout+Agreement+Template PDF

Partnership Buyout Agreement Template in Google Docs, Word, Pages, PDF

Free Partnership Buyout Agreement Template to Edit Online

Amazing Picture of Buyout Agreement Template letterify.info

Buyout Agreement Template PARAHYENA

Business Buyout Agreement Template Google Docs, Word, Apple Pages

A Buyout Refers To An Investment Transaction Where One Party Acquires Control Of A Company, Either Through An Outright Purchase Or By Obtaining A Controlling Equity Interest (At Least 51% Of.

Firms That Specialize In Funding And Facilitating Buyouts, Act Alone Or.

The Underlying Principle Is That.

Related Post: