Cogs Template

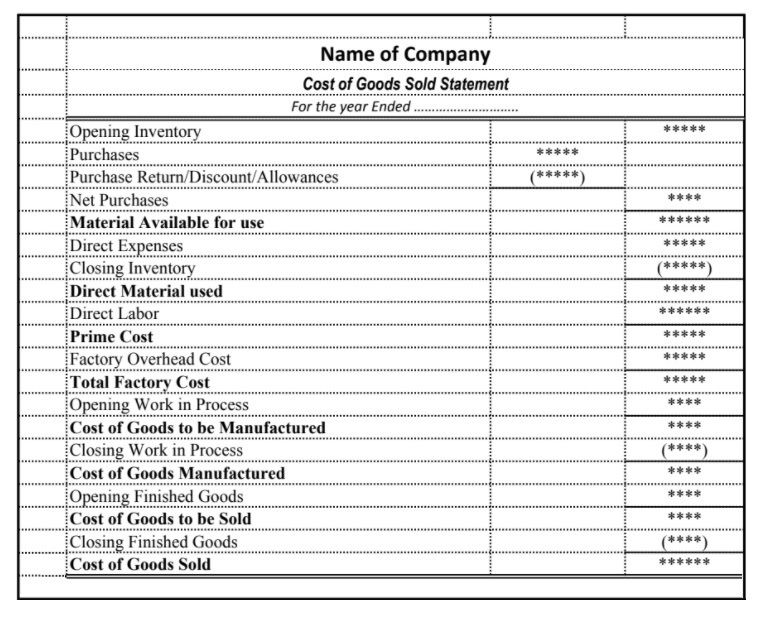

Cogs Template - It includes material cost, direct labor cost, and direct factory overheads, and is. This amount includes the cost of the materials and labor directly used to create. Sales revenue minus cost of goods sold is a business’s gross profit. This includes direct labor cost, direct material cost,. Cost of goods sold (cogs) is an accounting term for the direct costs of producing and selling goods or services. What is cost of goods sold? Cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing products that were sold during a period. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. It represents the amount that the business must recover when selling. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or. It includes material cost, direct labor cost, and direct factory overheads, and is. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. What is cost of goods sold (cogs)? Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. What is cost of goods sold? Cost of goods sold (cogs) is an expense, representing all of the direct costs a company incurs in the production and sale of its products and services. Calculating your cost of goods sold tells you how much it costs to create a product, so if you know your cogs, you know what price to sell your goods at to turn a profit. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. This amount includes the cost of the materials and labor directly used to create. What is cost of goods sold (cogs)? Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. It. Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. It includes material cost, direct labor cost, and direct factory overheads, and is. Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. Sales revenue minus cost. This amount includes the cost of the materials and labor directly used to create. Cost of goods sold (cogs) is an accounting term for the direct costs of producing and selling goods or services. Calculating your cost of goods sold tells you how much it costs to create a product, so if you know your cogs, you know what price. This includes direct labor cost, direct material cost,. Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Cost of goods sold (cogs) is an accounting term for the. It represents the amount that the business must recover when selling. It represents the total cost of the materials, labor, and overhead used to. Cost of goods sold (cogs) is an expense, representing all of the direct costs a company incurs in the production and sale of its products and services. Cost of goods sold (cogs), otherwise known as the. What is cost of goods sold? Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers. It includes material cost, direct labor cost, and direct factory overheads, and is. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or. Cost of goods sold (cogs) is an expense, representing all of the direct costs a company incurs in the production and. Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or. This includes direct labor cost, direct material cost,. It represents the total cost of. It represents the total cost of the materials, labor, and overhead used to. What is cost of goods sold? Cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold (cogs) is an expense, representing all of. Cost of goods sold is the direct cost incurred in the production of any goods or services. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or. Sales revenue minus cost of goods sold is a business’s gross profit. This includes direct labor cost,. Cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. Calculating your cost of goods sold tells you how much it costs to create a product, so if you know your cogs, you know what price to sell your goods at to turn a profit. It includes material cost, direct labor cost, and direct factory overheads, and is. Cost of goods sold (cogs) is an expense, representing all of the direct costs a company incurs in the production and sale of its products and services. Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service. Cost of goods sold (cogs) is an accounting term for the direct costs of producing and selling goods or services. Cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing products that were sold during a period. This includes direct labor cost, direct material cost,. It represents the total cost of the materials, labor, and overhead used to. Sales revenue minus cost of goods sold is a business’s gross profit. This amount includes the cost of the materials and labor directly used to create. It represents the amount that the business must recover when selling. Cost of goods sold (cogs) measures the “ direct cost ” incurred in the production of any goods or services. Cost of goods sold is the direct cost incurred in the production of any goods or services.Cost of Goods Sold (COGS) Template in Excel Download

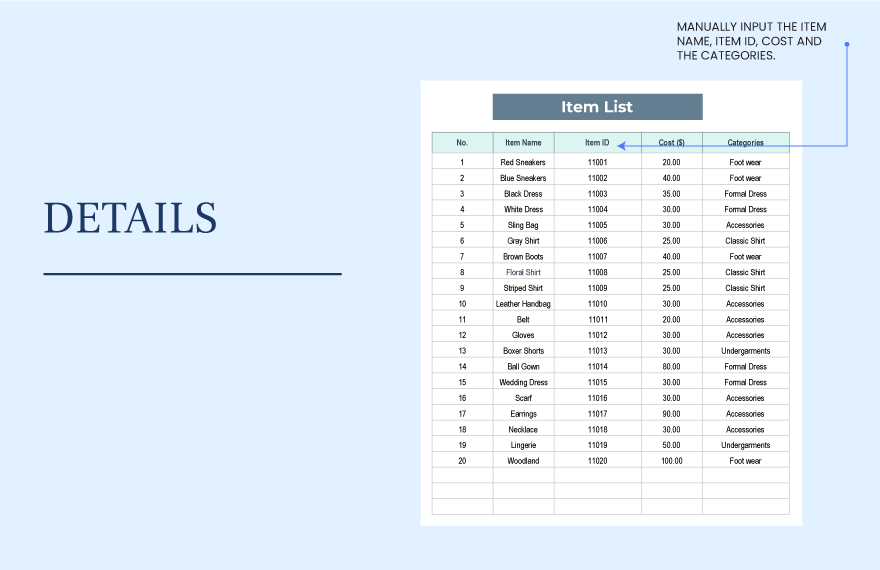

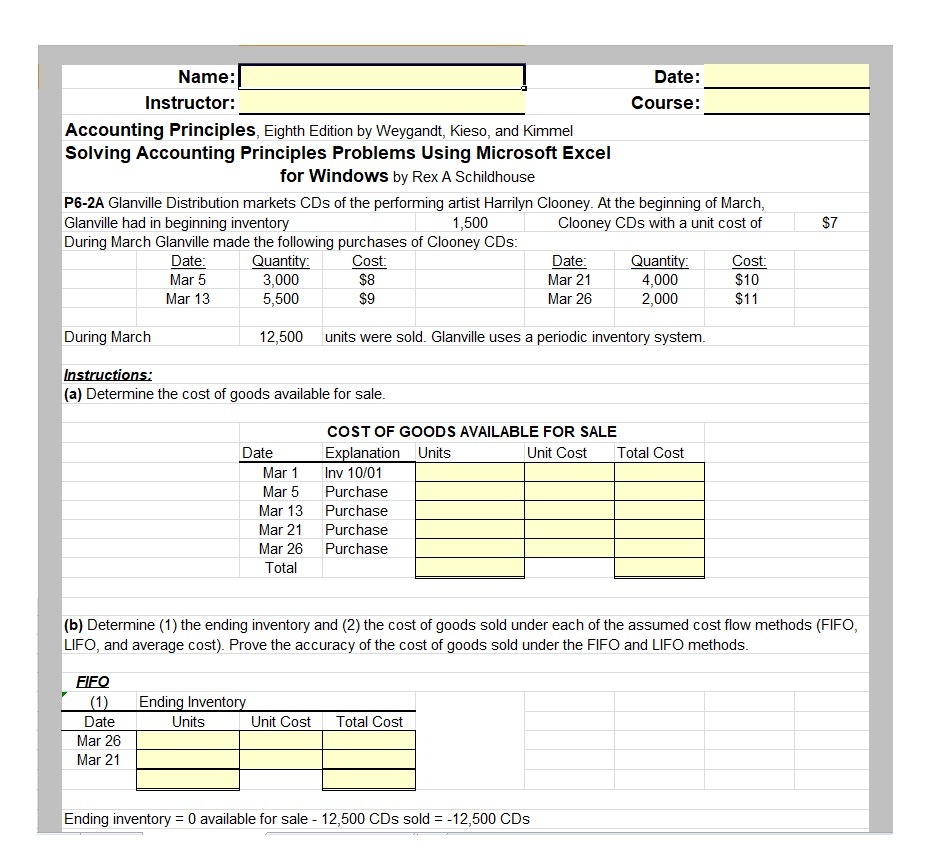

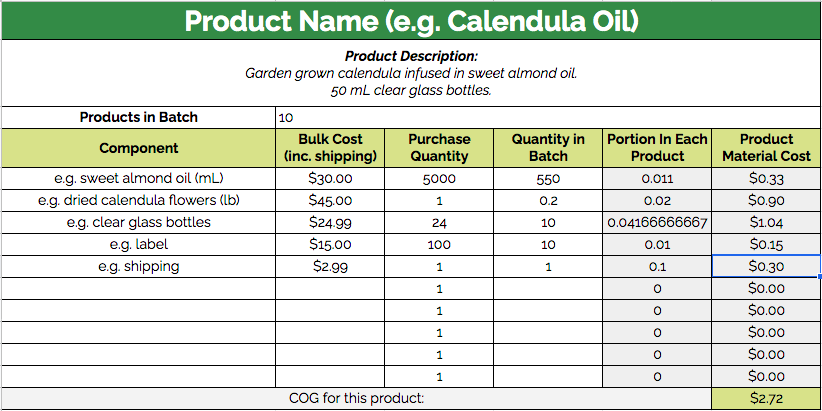

Cogs Excel Template

Cost Of Goods Sold Excel Template, Cost of goods sold (cogs) is the

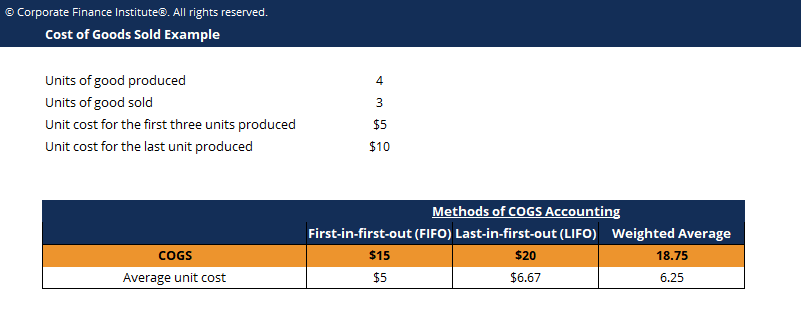

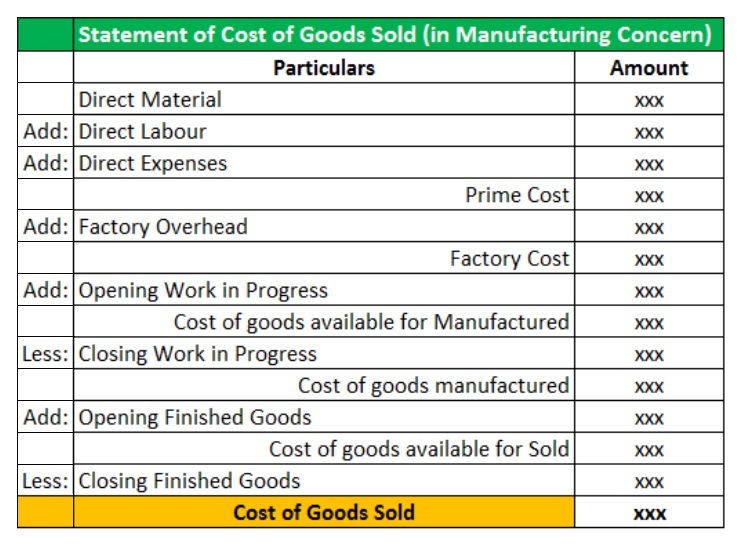

Cost of Goods Sold Learn How to Calculate & Account for COGS

Cost Of Goods Sold Excel Template, Cost of goods sold (cogs) is the

Cogs worksheet excel template cost of goods sold spreadsheet Artofit

popfopt Blog

Statement of Cost Goods Sold Template Free Excel Templates

Cost of Goods Sold (COGS) Template in Excel Download

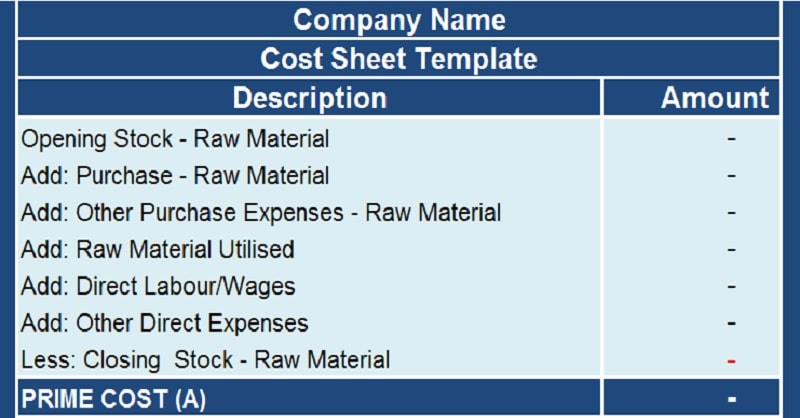

Download Cost Sheet With COGS Excel Template Cril Cafe

What Is Cost Of Goods Sold?

Cost Of Goods Sold (Cogs), Otherwise Known As The “Cost Of Sales”, Refers To The Direct Costs Incurred By A Company While Selling Its Goods Or.

Cost Of Goods Sold (Cogs) Is The Direct Cost Of A Product To A Distributor, Manufacturer, Or Retailer.

What Is Cost Of Goods Sold (Cogs)?

Related Post: