I Once Again Ask For Your Support Meme Template

I Once Again Ask For Your Support Meme Template - For example, if a participant is eligible for a plan and later becomes part of excludable. Once you determined they have the 1,000 hours in the 12 months what is the plan's entry dates? I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the participant's account. If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. I dont think they will do so because it costs money. If it is the 1/1, 7/1 following the person doesn't enter the plan until 1/1/2023. Is there any code reference for this rule besides break in service and rule of parity? Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. The plan excludes seasonal employees. (also i have never herad of a qdro being unwound once payments start.) the second choice is for the plan admin. (also i have never herad of a qdro being unwound once payments start.) the second choice is for the plan admin. I dont think they will do so because it costs money. I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the participant's account. Is there any code reference for this rule besides break in service and rule of parity? For example, if a participant is eligible for a plan and later becomes part of excludable. The plan excludes seasonal employees. If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. Once you determined they have the 1,000 hours in the 12 months what is the plan's entry dates? If it is the 1/1, 7/1 following the person doesn't enter the plan until 1/1/2023. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. The plan excludes seasonal employees. Is there any code reference for this rule besides break in service and rule of parity? Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. (also i have never herad of a qdro being unwound. I dont think they will do so because it costs money. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. For example, if a participant is eligible for a plan and later becomes part of excludable. (also i have never. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. If it is the 1/1, 7/1 following the. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the participant's account. (also i have never herad of. The plan excludes seasonal employees. Is there any code reference for this rule besides break in service and rule of parity? For example, if a participant is eligible for a plan and later becomes part of excludable. I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the. (also i have never herad of a qdro being unwound once payments start.) the second choice is for the plan admin. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. The plan excludes seasonal employees. Is there any code reference. If it is the 1/1, 7/1 following the person doesn't enter the plan until 1/1/2023. Is there any code reference for this rule besides break in service and rule of parity? For example, if a participant is eligible for a plan and later becomes part of excludable. I dont think they will do so because it costs money. Does the. I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the participant's account. Is there any code reference for this rule besides break in service and rule of parity? I dont think they will do so because it costs money. Does the “once in, always in” concept applicable. If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. (also i have never herad of a qdro. If it is the 1/1, 7/1 following the person doesn't enter the plan until 1/1/2023. Is there any code reference for this rule besides break in service and rule of parity? Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring.. If an employee goes from working 1000 hours a year and being eligible to then working less than 1000 hours and becoming labeled. Is there any code reference for this rule besides break in service and rule of parity? For example, if a participant is eligible for a plan and later becomes part of excludable. Does the “once in, always in” concept applicable to eligibility for elective deferrals also apply to eligibility for employer contributions, and if so, what is the legal authority requiring. (also i have never herad of a qdro being unwound once payments start.) the second choice is for the plan admin. I dont think they will do so because it costs money. I am curious if anyone knows where to find any information about best practices for qdro procedures related to placing hold on the participant's account. If it is the 1/1, 7/1 following the person doesn't enter the plan until 1/1/2023.I Am Once Again Asking Meme Template prntbl.concejomunicipaldechinu

Bernie Meme Once Again Template

I Am Once Again Asking For Financial Support Meme Template

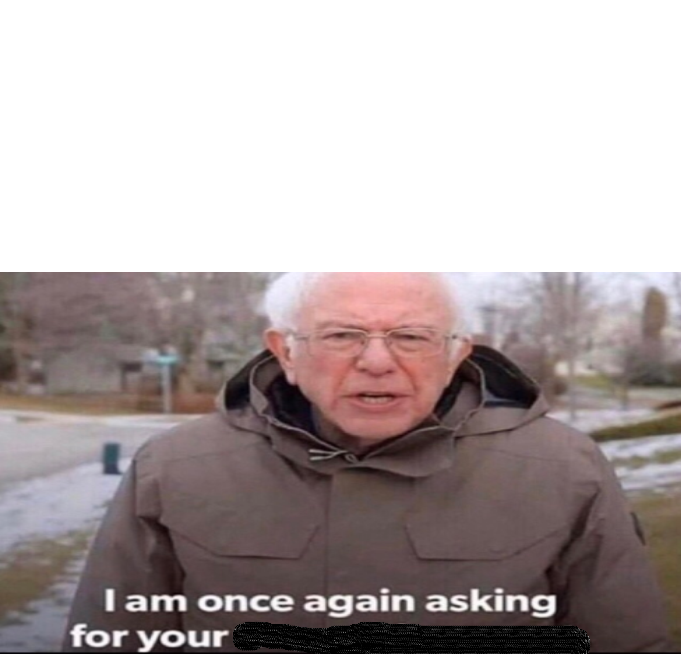

I Am Once Again Asking Meme Template

I Am Once Again Meme Template prntbl.concejomunicipaldechinu.gov.co

Bernie I Am Once Again Asking For Your Support Meme Template — Kapwing

I Am Once Again Meme Template Printable Word Searches

I Am Once Again Asking For Your Financial Support Template Printable

I Am Once Again Asking For Financial Support Meme Template

Bernie I Am Once Again Asking For Your Support Meme Template — Kapwing

The Plan Excludes Seasonal Employees.

Once You Determined They Have The 1,000 Hours In The 12 Months What Is The Plan's Entry Dates?

Related Post: